By: YBB Personal Finance

SENTIMENTS

AAII Bull-Bear Spread +3% (below average)

$NYA50R, NYSE %Above 50-dMA 51% (positive, barely)

$SPXA50R, SP500 %Above 50-dMA 58% (positive)

Delta MSI 56.9% (positive)

ICI Fund Allocations (Cumulative)

OEFs & ETFs: Stocks 60.84%, Hybrids 4.50%, Bonds 17.84%, M-Mkt 16.82%

INTEREST RATES

CME FedWatch

Cycle peak 5.25-5.50%

FOMC 9/18/24+ cut (25 or 50 bps cut)

FOMC 11/7/24+ cut

Next important event is Fed’s Jackson Hole conference August 22-24.

Treasury

T-Bills 3-mo yield 5.29%, 1-yr 4.33%; T-Notes 2-yr 3.88%, 5-yr 3.62%, 10-yr 3.80%; T-Bonds 30-yr 4.11%;

TIPS/Real yields 5-yr 1.73%, 10-yr 1.76%, 30-yr 2.04%;

FRNs Index 5.141%

US Savings I-Bonds, Rate from 5/1/24 – 10/31/24 is 4.28%; the fixed rate is 1.30%, the semiannual inflation is 1.48%.

For current banking rates, see www.depositaccounts.com/

Stable-Value (SV) Rates, 8/1/24

TIAA Traditional Annuity (Accumulation) Rates

Restricted RC 5.50%, RA 5.25%

Flexible RCP 4.75%, SRA 4.50%, Newer IRAs 4.75%

TSP G Fund 4.125% (previous 4.500%).

Due to publication lag, the data above are as of the Sunday preceding.

MARKETS

The US market turmoil continued due to change in outlook from goldilock to possible Fed error & soft landing or recession.

There have been wide swings in stocks, fear gauge VIX, bond yields, yen. High tech concentration in SP500 (LC-blend) is making it more volatile & it may soon become nondiversified (the LC-growth became so in mid-2022).

Indexing phenomenon is making the big bigger. The questions about the US FED’s autonomy or independence are creating uncertainties. Most global markets, including INDIA, also sold off. Japan was very volatile.

PRIVATE-CREDIT is looking beyond the Western world to Asia ex China (US-China tensions), ex Japan (plenty of easy credit there) – so, mostly, Australia, INDIA, etc. Banks still dominate lending in Asia (79%) vs the US (33% only). Private-credit provides funds to companies that cannot tap bank credit for various reasons.

A recent Barron’s story on Whole Foods (AMZN) & the fresh & healthy food revolution it launched in the US mentioned several Asian stores – H Mart (Korean), Patel Brothers (INDIAN), 99 Ranch (Chinese).

ECONOMY

CHINESE products keep coming to the US, tariffs & trade restriction notwithstanding. China has been stealthily tapping the US markets. Think Midea (bought German Kuka, etc) & Haier (bought GE Appliances) appliances, Anker & TenCent mobile games, Dirt Devil vacuums (Techtronic Industries), Geely (bought Swedish Volvo cars), Shein (low-priced retail), TikTok (ByteDance; banned in INDIA along with many other Chinese apps), Shenzhou (supplies Adidas, Nike), etc. Apple and Tesla have large manufacturing presence in China (although Apple is gradually shifting some operations to INDIA & elsewhere).

Chinese economy remains export-driven, & it is finding indirect ways to ship products globally & evading tariffs & other restrictions. Several Chinese companies have set up production in Europe, Middle East, Lat Am, EMs, even in the US. There is also the huge Belt & Road Initiative (BRI, 2013- ) involving dozens of countries & international organizations (notably missing is INDIA). Several Chinese companies hit by near-term by tariffs will eventually find ways around those tariffs. The US technology export restrictions didn’t hurt Huawei.

RETIREMENT

SOCIAL SECURITY needs fixing before 21% cuts in the SSA payouts are triggered in 2033. Both parties have differing plans for fixes, but neither wants to be specific about those before the election. Ad-hoc ideas like eliminating the Social Security tax for higher-income earners may harm Social Security. Conservative Heritage Foundation Project 2025 Report is another wild card (it wasn’t commissioned or endorsed by the GOP). A comprehensive SSA reform is urgently needed.

FUNDS

EM BONDS are attractive. Almost 60% of the EM debt is investment-grade sovereign debt with spreads over the US Treasuries. The EM corporates and HY have wider spreads. The EM debt has sold off on concerns about the slowing global economy, and the EM local-currency debt is more attractive now. Global EM indexes now include INDIAN bonds.

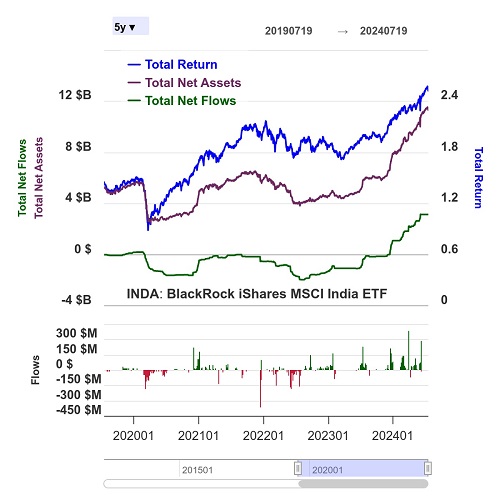

Several INDIA ETFs trading in the US were mentioned in a previous article. The biggest among these is the iShares INDA with the AUM of $11.15 billion. Its ER is 0.65%. It has about 70 large- & mid- cap holdings & the Top 10 holdings account for 37% of the AUM; it’s nondiversified.

For more information, visit:

ybbpersonalfinance.proboards.com/