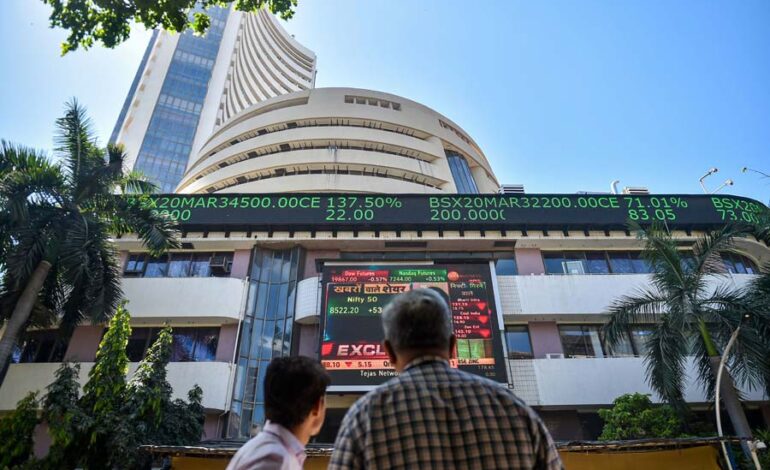

Sensex Drops 318 Points as Infosys and JSW Steel Lead Declines

Indian benchmark indices closed lower on Wednesday, with auto, IT, and PSU banks facing significant pressure.

The BSE Sensex ended at 81,501.36, down 318.76 points or 0.39%. The NSE Nifty finished at 24,971.30, down 86.05 points or 0.34%. The Nifty Midcap 100 index closed at 59,451.85, declining by 141.40 points or 0.24%, while the Nifty Smallcap 100 index managed a slight gain, ending at 19,304.90, up just 2.85 points or 0.01%. The Nifty Bank index slipped to 51,801.05, down 104.95 points or 0.20%.

The decline was led by sectors including auto, IT, PSU banks, pharma, FMCG, and metals, while the Nifty’s financial services, realty, energy, infrastructure, and oil and gas sectors showed strength. Overall, market sentiment remained positive, with 2,030 shares rising and 1,930 falling on the BSE, while 108 shares remained unchanged.

In the Sensex pack, HDFC Bank, Asian Paints, Bharti Airtel, and SBI emerged as top gainers, whereas M&M, Infosys, JSW Steel, Tata Motors, Titan, Kotak Mahindra, and ITC were among the biggest losers.

Foreign Institutional Investors (FIIs) ramped up their selling on Tuesday, offloading equities worth Rs 1,748.71 crore. Conversely, Domestic Institutional Investors (DIIs) increased their purchases, buying shares worth Rs 1,654.96 crore.

Market experts noted that the national market exhibited a range-bound trend with a negative bias, driven by concerns over a potential downgrade in FY25 earnings, which could threaten premium valuations. Participants are anticipating slow earnings growth in Q2FY25 amid weak demand and fluctuating input prices.

In commodity markets, gold prices remained high, gaining Rs 350 in MCX, while Comex gold traded above $2,675, reflecting a 0.55% increase. Traders are adjusting their positions in anticipation of continued interest rate cuts by the Federal Reserve.