Economic ripple effect: Tariffs and the cost of living in the US

Apr 4, 2025

By: Dr. Avi Verma

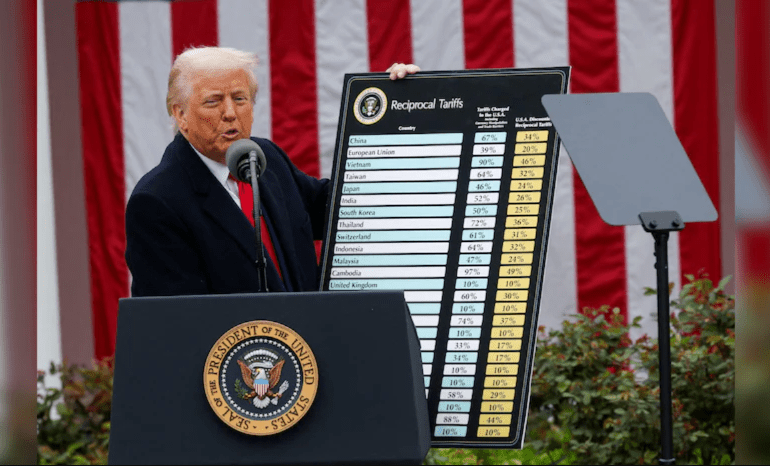

The “Liberation Day” tariffs, with their 10% universal levy and higher “reciprocal tariffs” on specific nations, are set to have a broad impact on the cost of goods in the United States. Here’s a breakdown of the likely effects:

Products Expected to Become Costlier:

- Electronics:

- Given the high tariffs on nations like China, Taiwan, and South Korea, expect price increases on electronics such as smartphones, televisions, and computers.

- This will affect a wide range of consumers, as these products are prevalent in households across all income brackets.

- Automobiles:

- Both imported vehicles and those with imported parts will become more expensive.

- This will impact car buyers nationwide, with potentially significant increases in the cost of both new and used vehicles.

- Clothing and Shoes:

- Apparel and footwear imported from countries like China, Vietnam, and Bangladesh will see price hikes.

- This will particularly affect budget-conscious consumers who rely on affordable clothing options.

- Food and Beverages:

- Imported food items, including coffee, chocolate, and certain fruits and vegetables, are likely to become more expensive.

- This will impact grocery bills for all Americans.

- Wine and spirits from European countries will also see price increases.

- Furniture:

- Furniture that is imported will also see price increases.

- Manufactured goods:

- Because of the nature of the universal 10% tarrif, almost all imported manufactured goods will see price rises.

Factors Influencing Regional Impact:

- Regions Reliant on Imported Goods:

- Areas with a high concentration of imported goods in retail stores will experience more significant price increases.

- Port cities and regions with strong trade ties to affected countries will also feel a greater impact.

- Automotive Industry Regions:

- Areas with a high concentration of automotive manufacturing or sales will be significantly affected by increased car prices.

- Regions Reliant on Specific Imports:

- For example, regions that rely heavily on produce from Mexico will see larger increases in grocery costs.

- Regions that rely on Canadian oil:

- Midwest and mountain west states will be heavily impacted by fuel price increases.

Factors that could lead to cheaper goods.

- If the tarrifs are very successful in bringing manufacturing back to the United states, then in the long term, some goods could be produced more cheaply domestically. This is a very big “if” however.

- If the tarrifs bring about trade negotations, that reduce or remove tarrifs, then goods could return to previous price points.

It’s important to note that the full economic impact of these tariffs is complex and subject to change. Retaliatory measures from other countries could further complicate the situation.