Gold & Silver

Dr K C Gupta, YBB Personal Finance

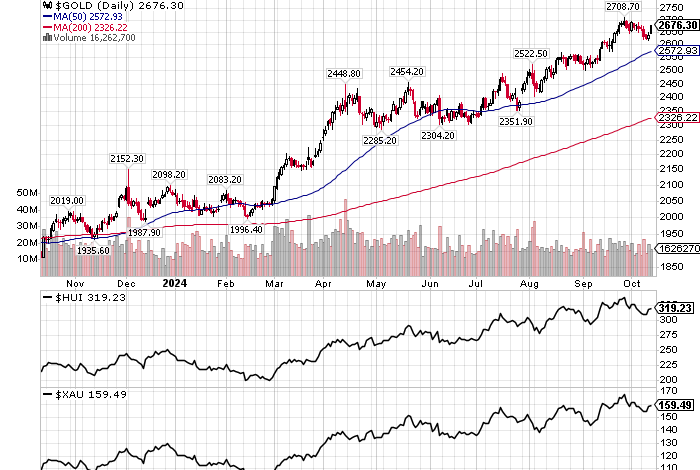

Gold broke out of a giant trading range in 03/2024. Recent events in the Middle East may have been the final trigger. Some see the Russia-Ukraine war (02/2022- ) as the trigger – gold initially kept falling in 2022, bottomed in September – November 2022, & then the current bull leg started stealthily until the breakout in 03/2024. Other factors contributing to the gold rally include global moves away from dollar due to aggressive US dollar-diplomacy, central bank gold purchases, rapidly rising US debt, & some hot money from cryptos.

A nearby StockCharts shows gold contract price ($GOLD) in the main panel, gold-silver mining index ($XAU) in the bottom panel & pure gold-mining index ($HUI) in the middle panel.

Gold has limited industrial uses & is used for jewelry, investments, & central banks reserves (#1-US, #2-Germany). Most of the gold ever mined is still around in some form. Silver on the other hand is both precious & industrial metal. Silver is also a byproduct of mining other metals.

Historically, gold &/or silver were used for, or to back, currencies, but that is no longer the case. New forms of digital-money or cryptocurrencies (Bitcoin, Ethereum, Litecoin, digital-yuan, etc) are also evolving; surprisingly, the emergence of these hurt gold as the traditional alternative to fiat-money.

Gold-bullion ETFs include large popular GLD (ER 40 bps) & IAU (25 bps), but there are several newer ones with lower ERs, IAUM (9 bps; baby IAU), GLDM (10 bps; baby GLD), SGOL (17 bps), etc; the silver-bullion ETFs are SLV, SIVR. Some large ETFs with high ERs exist because they have more liquidity for large institutional trades, but this will change in the future.

Some of these ETFs make points about holding only bullion, how & where, vs using some futures contracts (paper- gold or silver). But these issues are more for marketing & PR. Also beware that capital gains on sale are taxed at higher collectibles tax rates. The Canadian bullion closed-end funds CEF (gold & silver) & PHYS (gold) may trade at premiums/ discounts & also have special PFIC tax issues for the US investors. Investors worried about access to physical gold or silver should buy & hold biscuits, coins, bars.

Gold-mining ETF GDX follows the Gold Miners Index & holds major gold producers including many companies in South Africa. Junior GDXJ follows Junior Gold Miners Index & at one time it had only small-cap producers. But as it became big, it added mid/large-cap companies & is now mid-cap overall although it retains “Junior” in its name. Both GDX & GDXJ are concentrated. The silver-mining ETFs include SIL, SLVP, SILJ.

Gold-mining industry has changed over time. It no longer emphasizes exploration & production (E&P) but focuses on profitability & cash flow; some even pay dividends, with variable dividends common. They have high fixed costs, so, when gold prices rise above certain thresholds, those just flow to the profits (the bottom line). This is why the gold-mining ETFs have much more leverage & volatility than the bullion ETFs; GDX has 2.5x the volatility of GLD, & GDXJ 3x.

Gold-bullion measures have their own terminology. So, 1 Troy pound (Troy LB or Lbt) of gold has 12 Troy ounces (Troy oz or ozt or toz) of gold, unlike the usual 1 pound (Lb) of other things that has 16 ounces (oz). Some other conversions:

1 Troy oz = 31.1034768 grams

1 Tonne = 1,000 kg = 1,000,000 gm = 32,150.7465686 Troy oz

1 Tola = 0.375 Troy oz = 11.6638038 gm (tola is used in India & several Middle Eastern countries)

Gold fineness (or purity) is expressed by 3 digits as parts per thousand. An alternate measure is the Karat scale that has 24k for pure gold, but pure gold is never 100% gold, & 995-999 fineness (99.5-99.9% purity) is considered pure gold; note that the term carat is used for gemstones. Some examples:

Fineness 995-999 = 24k

Fineness 916-917 = 22k (common 916; 22/24 = 0.916666)

Fineness 750 = 18k (18/24 = 0.750)

Fineness 583-585 = 14k (common 585; 14/24 = 0.583)

Because 24k gold is too soft, most gold jewelry uses 22k or lower. Alloying metals or materials may give gold distinctive colors (other than yellow) – white, pink, blue, purple, black, etc. Cheaper jewelry uses coatings of gold on some base metals, & depending on the thickness of the gold layer, it may be called gold-filled, gold-vermeil, or gold-plated.

For more details, see https://ybbpersonalfinance.proboards.com/