Personal finance insights: Market sentiments, investment strategies & economic trends

Dr K C Gupta, YBB Personal Finance

SENTIMENTS

AAII Bull-Bear Spread +24.4% (high)

$NYA50R, NYSE %Above 50-dMA 71.82% (overbought)

$SPXA50R, SP500 %Above 50-dMA 79.00% (overbought)

Delta MSI 74.4% (overbought)

ICI Fund Allocations (Cumulative)

OEFs & ETFs: Stocks 60.98%, Hybrids 4.48%, Bonds 17.94%, M-Mkt 16.61%

INTEREST RATES

CME FedWatch

Cycle peak 5.25-5.50%

Current 4.75-5.00%

FOMC 11/7/24+ cut (50 bps)

FOMC 12/18/24+ cut

Treasury

T-Bills 3-mo yield 4.75%, 1-yr 3.92%; T-Notes 2-yr 3.55%, 5-yr 3.48%, 10-yr 3.77%; T-Bonds

30-yr 4.07%;

TIPS/Real yields 5-yr 1.46%, 10-yr 1.58%, 30-yr 1.93%;

FRNs Index 4.808%

US Savings I-Bonds, Rate from 5/1/24 – 10/31/24 is 4.28%; the fixed rate is 1.30%, the

semiannual inflation is 1.48%.

For current banking rates, see www.depositaccounts.com/

Stable-Value (SV) Rates, 9/1/24

TIAA Traditional Annuity (Accumulation) Rates

Restricted RC 5.25%, RA 5.00%

Flexible RCP 4.50%, SRA 4.25%, IRA-101110+ 4.50%

TSP G Fund 4.000% (previous 4.125%)

Due to publication lag, the data above are as of the Sunday preceding.

MARKETS

The US FED rate cut of 50 bps should be a global relief. The US market valuations are high with

fwd P/E 21.1 & lower rates should be supportive of the market. The INDIAN markets should also

benefit as the RBI has room to cut rates, but it was waiting for the Fed to move (after the ECB

had moved).

Tax-Loss Harvesting (TLH). The last day to DOUBLE-UP & sell the older lot by the yearend is

Friday, 11/29/24 (early NYSE close at 1 PM ET) in order to avoid wash-sale. With commission-

free trading, this practice is less popular now. It is easily possible to sell & simultaneously buy

something SIMILAR BUT NOT IDENTICAL.

Japanese Nippon Steel’s bid for US Steel/X is in trouble. A new positive development is that the

CFIUS has delayed its recommendation until after the November elections. Nippon Steel

underestimated the unions & the nationalist sentiments in the US, but now it has more time to

address concerns. Nippon + US Steel combination would move Japan to #2 spot from #3 in

global steel production (now #1 China, #2 India, #3 Japan, #4 US). If the deal is rejected, Japan

will swallow its pride & continue with its US foreign direct investments (FDIs) as its options are

limited – it no longer finds China or post-Brexit UK attractive, & the other EMs – India, SE Asia –

won’t move the needle much.

INDIA now has the largest weight among the EMs in the MSCI All-Country IMI (investible) index

- it’s ahead of China & just behind France; the US ETFs are SPGM, AVGE.

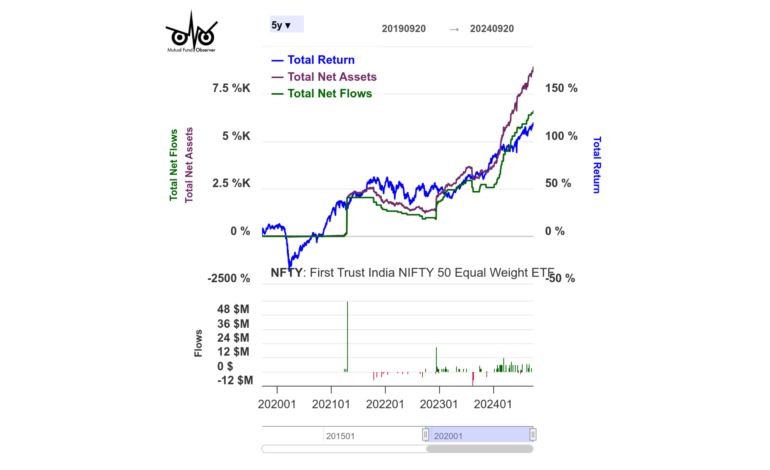

This week’s focus is on NFTY, a smaller India ETF in the US with a catchy name. Its AUM is

$281 million & ER is 0.80%. Its benchmark is an equal-weight index of 50 large-cap (LC) Indian

companies. The NSE Nifty Fifty index is a free-float market-cap weighted index of the largest

Indian companies & is LC-growth. However, the ETF NFTY follows an equal-weight version of

this index. According to Morningstar, it is large-cap-growth but has shareholder-yield emphasis

(shareholder yield = dividend yield + buyback yield) with somewhat lower momentum. NFTY’s

top 3 sectors are financials, consumer-cyclical & information technology. It’s rebalanced

quarterly & reconstituted semiannually. NFTY has existed in its current form only since 4/17/18,

so its long-term performance beyond 6.5 years isn’t relevant. The MFO Premium 5-yr chart

(“Relative” view with changes from the start of the period) nearby shows large inflows in

04/2021 & 12/2022; the current bull run is from 03/2023; also shown are changes in the total

returns (TR) & assets (AUM).

For more information, see ybbpersonalfinance.proboards.com/