Publisher’s note: The tariff tango – a retreat or a reroute?

By: Dr. Avi Verma, Publisher

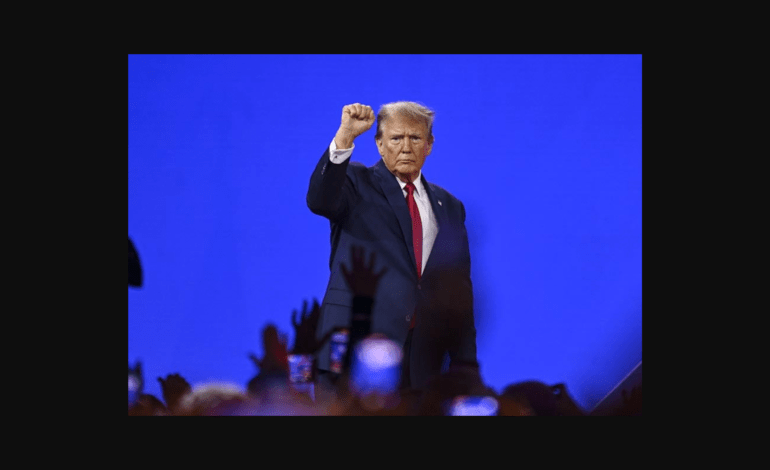

The recent executive order from President Trump rolling back “reciprocal” tariffs on hundreds of food products—including staples like beef, coffee, bananas, and spices—has sent ripples through Washington and global markets. The move, which exempts over 200 items from the duties imposed earlier this year, sparks a critical question: Did the administration “blink” under the pressure of rising grocery costs, or is this a calculated adjustment within a broader, aggressive trade strategy?

Blink or Strategy? The Domestic Calculus

While the White House frames the modification as a result of “substantial progress” in securing more reciprocal trade deals and a strategic decision to strengthen U.S. supply chains, the context of soaring domestic grocery prices is undeniable. Consumer angst over the cost of living, which has been a rallying point for opposition, appears to have forced a tactical correction.

- The Affordability Pressure: The rollback came on the heels of mounting public frustration and a series of election results where “affordability” was a key concern. By cutting tariffs on widely consumed, non-domestically produced goods, the administration implicitly acknowledges that its tariffs were, in fact, contributing to inflation—a claim it had long dismissed.

- The Strategic Angle: However, the move is not a complete surrender of the tariff-as-tool philosophy. The administration simultaneously announced framework trade deals with several Central and South American nations to further reduce duties on specific items, suggesting a pivot toward selective bilateral negotiations to achieve trade reciprocity, rather than a monolithic global tariff wall. It’s a nuanced recalibration: maintain the high-tariff leverage globally, but selectively ease pressure where domestic consumer pain is most acute.

Impact on India and Indo-US Relations

For India, the tariff situation is especially fraught, as it has been facing a staggering 50% tariff—comprising a 25% reciprocal tariff and an additional 25% penalty linked to its continued purchase of Russian crude oil.

- A Partial Reprieve: The exemptions on agricultural products like spices, tea, coffee extracts, and certain nuts offer a welcome relief for India’s exporters in these specific sectors, potentially impacting over $1 billion in trade. It levels the playing field for these goods, which had been disadvantaged by the high duties.

- The Core Sticking Point Remains: Crucially, the major U.S. tariffs on key Indian exports like textiles, gems and jewellery, leather, and seafood—and especially the additional 25% penalty for Russian oil imports—remain in place. This high-tariff regime continues to jeopardize significant portions of India’s exports to the U.S. and complicates the bilateral strategic partnership.

- The Path to Repair: Indian officials maintain that the relationship remains “very important and very strategic” and that a “good news” trade deal is possible once a “fair, equitable, and balanced” agreement is reached. The recent moves, including Reliance Industries halting Russian crude imports for its export-oriented refinery, hint at India’s effort to address the core sanction issue.

Is it too late to repair relations? The consensus is no. The comprehensive nature of the Indo-US strategic and defense partnership provides a strong anchor. While the 50% tariff has caused significant economic strain and diplomatic tension, trade talks continue. The limited rollback offers a psychological opening, even as New Delhi maintains a posture of being “ready to wait” for a favorable, comprehensive deal.

Global and US Market Reaction

The global market response to the Trump administration’s shifting trade policy remains characterized by volatility and uncertainty, despite the partial rollback.

- US Markets (The Consumer Effect): The primary immediate impact is an expected, though likely slow, moderation of price hikes on specific imported food items, which is positive for consumers. However, the broader trade policy remains a source of unease. While the narrower August trade deficit (attributed to reduced imports ahead of the original tariffs) was a temporary tailwind for Q3 GDP, the overall sentiment remains cautious due to the sustained high duties on industrial goods and the ongoing legal challenges to the tariffs’ legality.

- Global Supply Chains: The tariffs have already spurred diversification away from the U.S. in many countries, as seen by Indian exporters increasingly looking to Europe and Africa. The selective nature of the rollback might lead to a further fragmentation of global supply chains—a benefit for countries that secure tariff-free access and a challenge for those still facing high duties.

In conclusion, the food tariff rollback is less a full retreat and more a tactical maneuver to mitigate immediate domestic political and economic blowback. It demonstrates that tariffs, while a powerful tool, are not immune to the pressures of consumer inflation. The trade war, however, is far from over, as the core reciprocal and punitive tariffs remain in place against many major partners, including India, keeping geopolitical and market tensions elevated