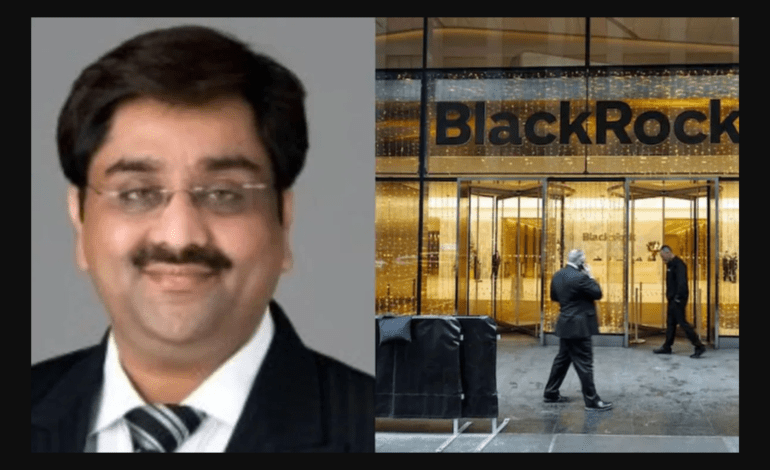

Indian-origin CEO accused of $500 million global loan fraud: Who is Bankim Brahmbhatt?

Indian-origin telecom executive Bankim Brahmbhatt, head of the Bankai Group, is facing explosive allegations of orchestrating a $500-million international loan fraud that reportedly deceived BlackRock’s private-credit unit and multiple global lenders. The accusations — described as “breathtaking” by The Wall Street Journal — stem from a lawsuit filed in the United States in August 2025.

Who is Bankim Brahmbhatt?

Brahmbhatt is associated with Broadband Telecom and Bridgevoice, two relatively low-profile entities in the global telecom-services ecosystem. Both operate under the umbrella of the Bankai Group, which describes itself as a “globally recognised leader in the telecommunications industry” working closely with telcos and carrier-business networks.

The Bankai Group’s X (formerly Twitter) account identifies Brahmbhatt as the company’s President & CEO. Until recently, he also maintained offices in Garden City, New York, according to the WSJ report. A LinkedIn profile believed to belong to him has since been taken down.

According to company information, Brahmbhatt’s businesses claim to provide infrastructure, routing, and connectivity solutions to telecom operators worldwide.

The alleged $500-million scam

The lawsuit filed by lenders — led by HPS Investment Partners, a large private-credit firm now owned by BlackRock — accuses Brahmbhatt of fabricating invoices and accounts receivable. These allegedly falsified financial statements were reportedly pledged as collateral for hundreds of millions of dollars in loans.

The complaint further alleges that Brahmbhatt used a network of related financing vehicles, including Carriox Capital and BB Capital SPV, to create the appearance of a robust, revenue-generating telecom business. In reality, lenders claim, the transactions on paper did not reflect genuine commercial activity.

Investigators believe that Brahmbhatt’s companies created an illusion of financial strength while allegedly transferring funds offshore to India and Mauritius. Both Bankai Group entities and Brahmbhatt himself have now reportedly filed for bankruptcy, the WSJ reported.

Despite the scale of the accusations, Brahmbhatt’s lawyer has denied all allegations, calling the lawsuit “baseless” and asserting that no fraud was committed.

The case is emerging as one of the biggest alleged telecom-financing frauds involving an Indian-origin executive on the global stage, with lenders seeking to recover losses exceeding half a billion dollars.